amazon flex taxes form

Keeper helps you to save tax on other expenses as tax write. Amazon Flex quartly tax payments Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

600 is the IRS minimum and it costs Amazon money to send tax forms.

. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of FederalState Copys 1096s Great for QuickBooks and Accounting Software 2021 1099-NEC. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. Are you making money by driving for Amazon Flex.

If you made less than 600 you usually wont get a 1099 for Amazon Flex income. We would like to show you a description here but the site wont allow us. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or 1042-S reporting.

45 out of 5. How Much Tax You Pay On Amazon Flex Earnings. When youre self-employed youll pay income tax Class 2 and Class 4 national insurance on the profits as a driver.

Increase Your Earnings. Service income to US. The 1099-K form will be used to report your income to the IRS and the W-9 form will be.

Form 1099-NEC is used to report nonemployee compensation eg. To file your Amazon Flex taxes you will need to fill out a 1099-K form and a W-9 form. Or download the Amazon Flex app.

This is the non-employee compensation 1099 form you receive from Amazon Flex if you earn at least 600 with them if it is under 600 you will not receive the form -- but. Form 1099-NEC is replacing the use of Form 1099-MISC. Tap Forgot password and follow the instructions to receive assistance.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906. Gig Economy Masters Course. Most drivers earn 18-25 an hour.

Amazon will send you a 1099 tax form stating your taxable income for the year. No matter what your goal is Amazon Flex helps you get there. 1099 MISC Forms 2022 4 Part Tax Forms Kit 25 Vendor Kit of Laser Forms Compatible with QuickBooks and Accounting Software.

Select Sign in with Amazon. If you are a US. Amazons Choice for 1099 misc tax form.

Payments Taxes Income Uber Drivers Forum For Customer Service Tips Experience

How To File Amazon Flex 1099 Taxes The Easy Way

Tax Forms Email R Amazonflexdrivers

Ducktrapmotel Consumer Questions Answered

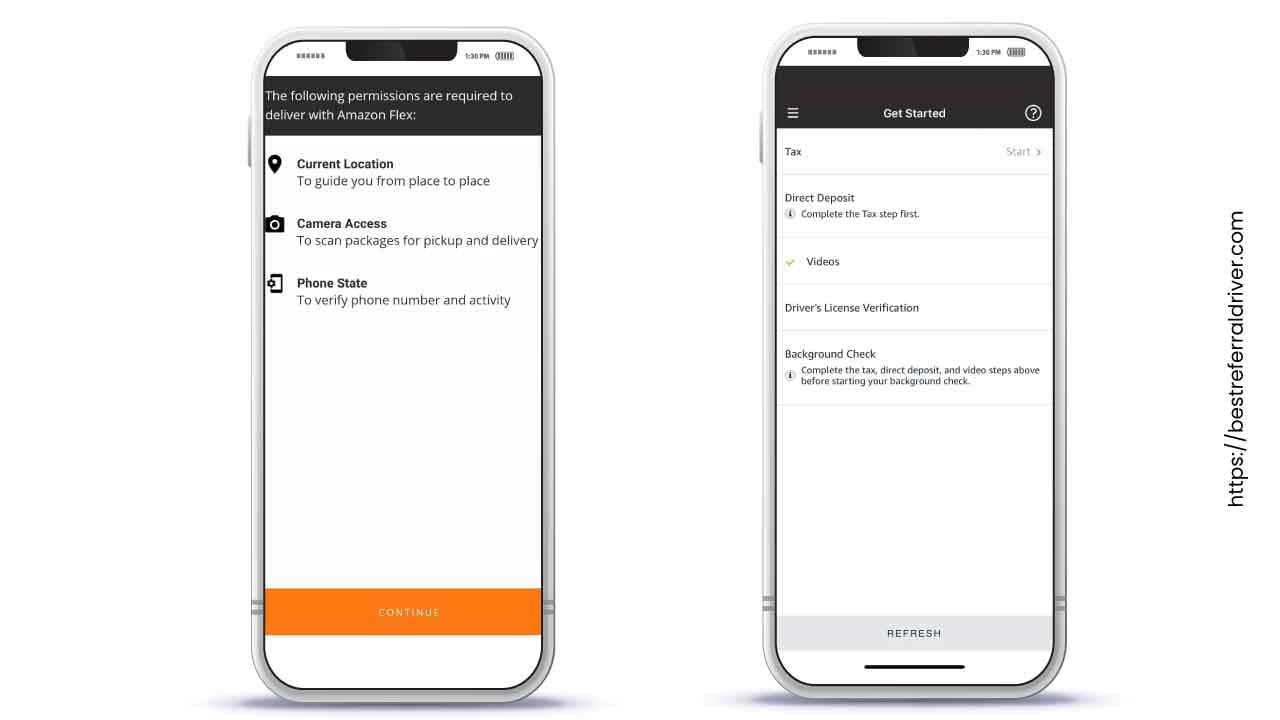

How To Apply For Amazon Flex Driver Jobs Career Info

The Best Tips For Amazon Flex Fba Drivers Everlance

How To File Your Uber Driver Tax With Or Without 1099

How To Make Money On The Side With Amazon Flex

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

How To File Self Employment Taxes Step By Step Your Guide

Amazon Flex Taxes Documents Checklists Essentials

Filing Taxes 1099 Forms Every Independent Contractor Should Know About Moves Financial

How To File Your Uber Driver Tax With Or Without 1099

Tax In Progress For 3 Days Is Is Normal R Amazonflex

All About Amazon Flex Driver In Australia Requirements Pay Rate Registration And More

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers